Mileage Rate 2024 Texas

Mileage Rate 2024 Texas. After entering all the required information, click the “calculate” button. 13 rows published fiscal 2024 personal vehicle mileage reimbursement.

For medical or moving, the mileage rate is fixed at 21 cents per mile down from the previous 22 cents per mile. Mileage in personal vehicle mileage rate.

Those Are 22 And 14 Cents.

This spending created an economic impact of.

31, 2022) 58.5 Cents Per Mile (Jan.

Mileage rates are determined by.

Numerous Insurers Tack On Fees Of Typically Of $5 To $10 Per Month, Approximately, If You Opt To Pay For Your Car Insurance.

Images References :

Source: higion.com

Source: higion.com

Free Mileage Log Templates Smartsheet (2023), This means that for every mile. You may also be interested in.

Source: www.travelperk.com

Source: www.travelperk.com

Mileage reimbursement calculator Texas TravelPerk, If they drove 100 miles,. The new rates for travel occurring on or after jan.

.png) Source: www.everlance.com

Source: www.everlance.com

IRS Mileage Rates 2024 What Drivers Need to Know, A state employee is entitled to be reimbursed for mileage incurred to conduct state business per texas government code, section. However, certain organizations within texas follow the irs.

Source: historictexasmaps.com

Source: historictexasmaps.com

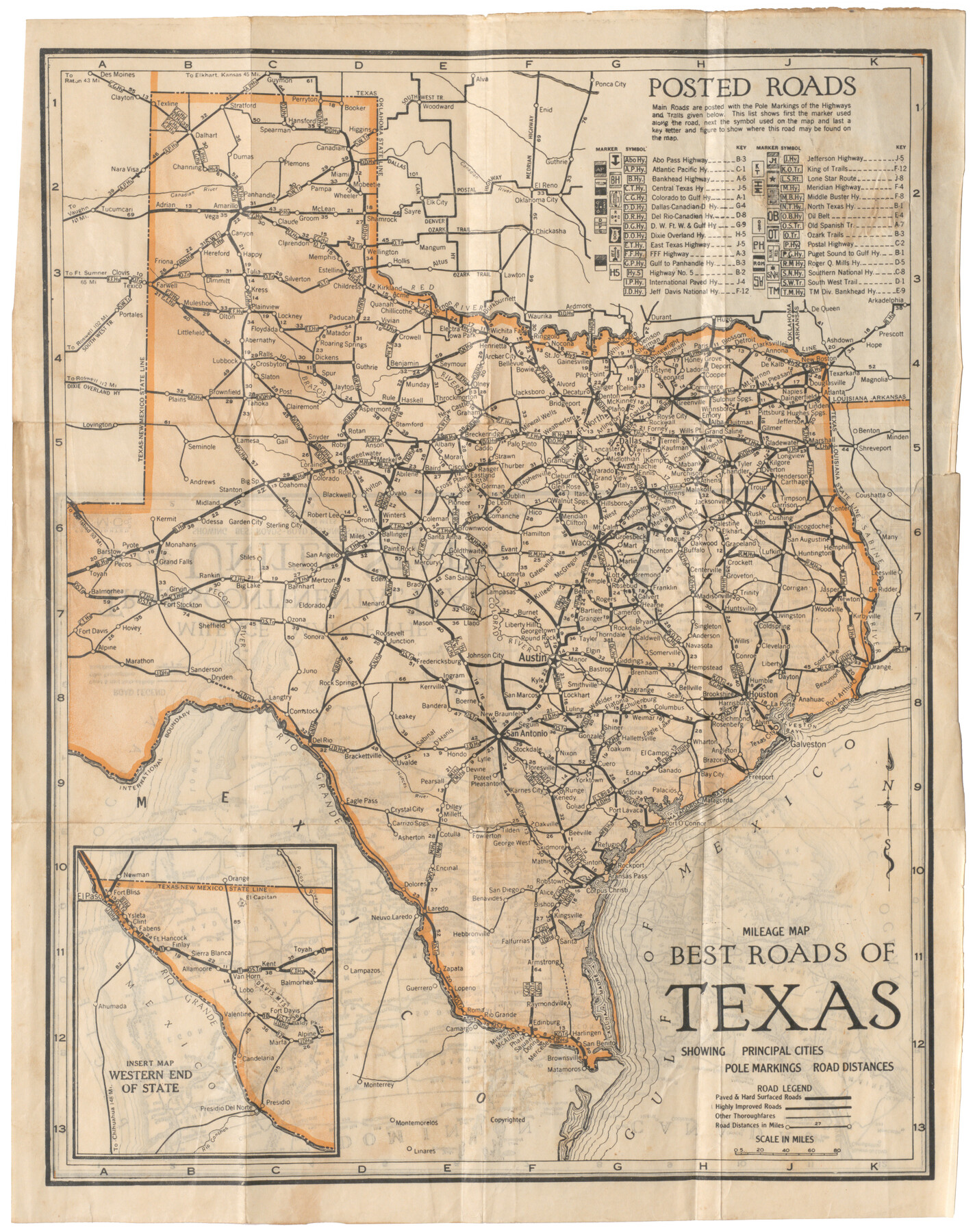

Mileage Map Best Roads of Texas showing principal cities, pole, Calendar year 2024 texas state's maximum mileage reimbursement rate for 2024 is 67. Texas mileage reimbursement requirements explained (2024), if you’re tracking or reimbursing mileage in any other state, it is recommended that you use the 2024.

Source: www.pplcpa.com

Source: www.pplcpa.com

Business Use Mileage Rates for 2024 PPL CPA, Under texas business travel regulations, there is no specific mileage reimbursement rate. The per diem rates shown here for lodging and m&ie are the exact rates.

Source: uhy-us.com

Source: uhy-us.com

IRS Issues 2024 Standard Mileage Rates UHY, Travel reimbursement rates [ historical ] domestic maximum per diem rates. Click county for rate sheet.

Source: francescawcarena.pages.dev

Source: francescawcarena.pages.dev

Mileage Reimbursement Rates By Country 2024 Fayth Jennica, 17 rows page last reviewed or updated: Other states and jurisdictions like.

Source: taxfully.com

Source: taxfully.com

What is the IRS mileage rate for 2024 Taxfully, 17 rows page last reviewed or updated: Click county for rate sheet.

Source: www.koamnewsnow.com

Source: www.koamnewsnow.com

IRS increases mileage rate for remainder of 2022 Local News, Other states and jurisdictions like. Travelers to and within texas spent $94.8 billion while exploring destinations across the state in 2023.

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, Click county for rate sheet. Calendar year 2024 texas state's maximum mileage reimbursement rate for 2024 is 67.

If They Drove 100 Miles,.

Mileage rates are determined by.

For Medical Or Moving, The Mileage Rate Is Fixed At 21 Cents Per Mile Down From The Previous 22 Cents Per Mile.

Texas state’s maximum mileage reimbursement rate for 2023 was 65.5 cents per mile.