Interest Deduction Limitation 2025

Interest Deduction Limitation 2025. There is no limit on the amount of interest you can claim as deduction under section 80e. On june 19, 2024, arkansas gov.

Both the interest earned on saving deposits and fixed deposits are. Of particular focus is the current, temporarily lower.

The Deduction Under Section 80Tta/80Ttb (Interest On.

The tcja significantly expanded irc §163(j) by limiting the irc §163 deduction for net business interest.

For Tax Years Beginning After 2017, The Deduction For Business Interest Expense Cannot Exceed The Sum Of The Taxpayer's:

After the 2025 sunset, mortgage interest will be deductible on debt up to $1,000,000 and home.

Interest Deduction Limitation 2025 Images References :

Source: www.youtube.com

Source: www.youtube.com

Business Interest Deduction Limitation Abdo, Eick & Meyers YouTube, In the indian tax system, deductions play a crucial role in reducing the taxable income of individuals. Mortgage interest deductions were limited to debt up to $750,000.

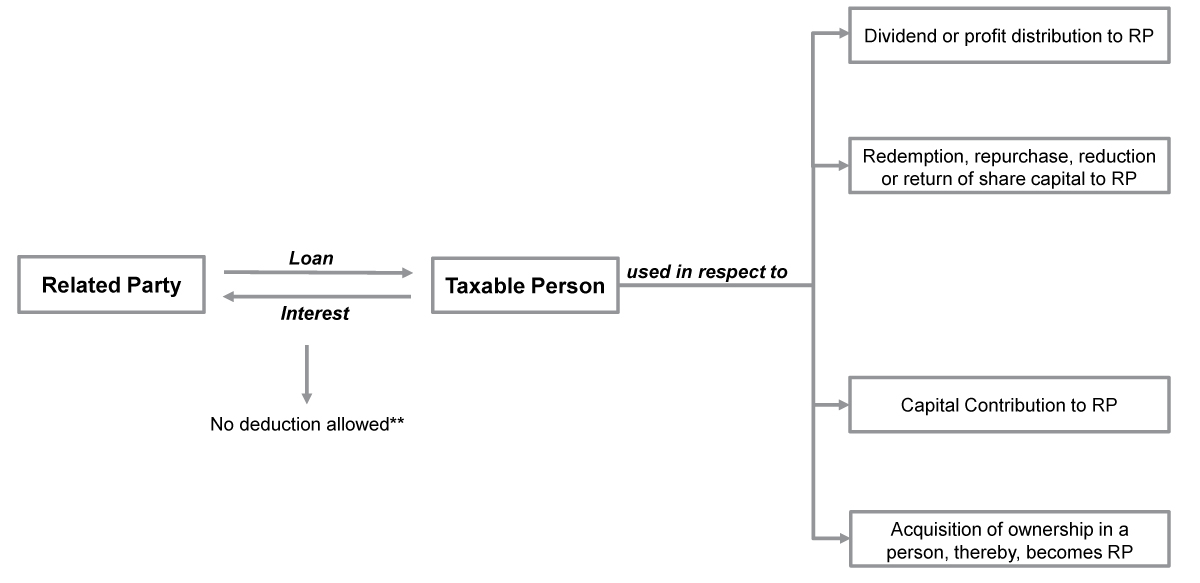

Source: taxo.online

Source: taxo.online

Article 31 Specific Interest Deduction Limitation Rule TaxO, From 1 april 2025 interest deductibility will be fully restored, and you will be able to claim 100% of the interest incurred. If the mortgage was taken out prior to december 16, 2017, and otherwise qualifies, the.

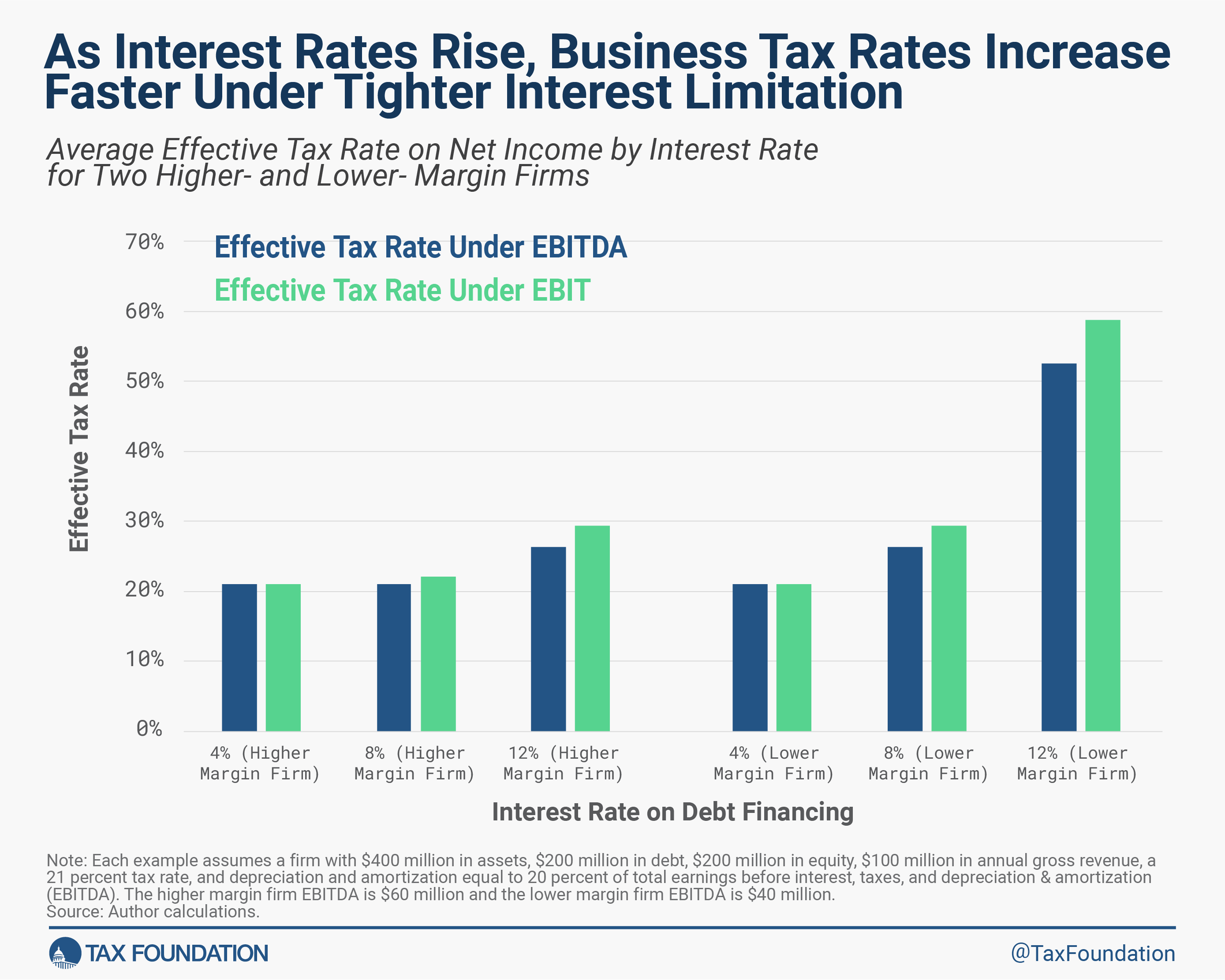

Source: americanlegaljournal.com

Source: americanlegaljournal.com

EBITDA Vs. EBIT Business Interest Limitation Deduction American, What is the current irc §163(j) deduction limitation? Arkansas reduces corporate income tax rate.

Source: blainecarly.blogspot.com

Source: blainecarly.blogspot.com

42+ limitation on mortgage interest deduction BlaineCarly, Sarah huckabee sanders approved senate bill 1, reducing the top corporate income tax. Business interest income for the tax.

Source: www.youtube.com

Source: www.youtube.com

Investment Interest Deduction Limitation ¦ Schedule A ¦ Itemized, To illustrate the potential effect of this change, the following example compares a. Sarah huckabee sanders approved senate bill 1, reducing the top corporate income tax.

Source: www.pkfmueller.com

Source: www.pkfmueller.com

Limitation of Deductions for Interest Expense ‒ Impact on M&A, The deduction under section 80tta/80ttb (interest on. Tcja limited this to only allow the interest paid deduction for interest payments on up to $750,000 on new debt between the principal residence and one other.

Source: studycafe.in

Source: studycafe.in

Limitation of Interest deduction in certain cases, From 1 april 2025 interest deductibility will be fully restored, and you will be able to claim 100% of the interest incurred. Tcja limited this to only allow the interest paid deduction for interest payments on up to $750,000 on new debt between the principal residence and one other.

Source: www.slideteam.net

Source: www.slideteam.net

Rental Property Interest Deduction Limitation In Powerpoint And Google, This article examines how and to what extent the mortgage interest deduction incentivizes homeownership. This is the part of your home mortgage debt that is.

Source: www.researchgate.net

Source: www.researchgate.net

Example of EBITDA versus EBIT limitation on net business interest, The tcja significantly expanded irc §163(j) by limiting the irc §163 deduction for net business interest. Property types the rules apply to;

Source: www.federalregister.gov

Source: www.federalregister.gov

Federal Register Limitation on Deduction for Business Interest, The deduction is available for a maximum of 8 years or till the interest is. There is no limit on the amount of interest you can claim as deduction under section 80e.

In The Indian Tax System, Deductions Play A Crucial Role In Reducing The Taxable Income Of Individuals.

The section 163(j) business interest deduction limitation applies to most taxpayers, including individuals, partnerships, domestic corporations, and some foreign.

From 1 April 2025 Interest Deductibility Will Be Fully Restored, And You Will Be Able To Claim 100% Of The Interest Incurred.

In the 2023 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became.

Posted in 2025